That XBIO Stock Explosion: What the Hell Is Happening and Is It Just Another Pump and Dump

Let's get one thing straight. When a tiny, money-losing biotech company you’ve never heard of suddenly rockets 160% in a single day on zero news, it’s not because investors suddenly discovered the cure for cancer in an old SEC filing.

Give me a break.

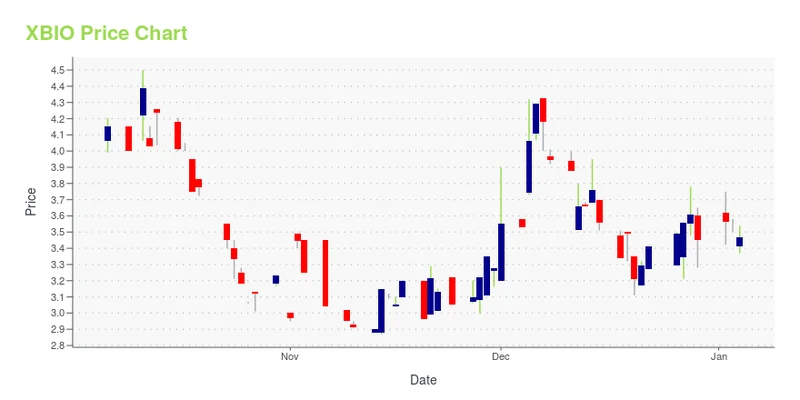

On October 8, Xenetic Biosciences (XBIO), a company with a market cap smaller than a rounding error for Pfizer, went completely vertical. The stock, which was bumping around $3 a share, touched over $12. We’re talking about a 350% gain in less than a week. The official story, cobbled together by financial news sites desperate for a narrative—with headlines like XBIO Shares Skyrocket: Exploring the Surge—was a mix of "positive market sentiment" and vague mentions of old news about clinical trials from July.

This is a bad explanation. No, "bad" doesn't cover it—this is a five-alarm dumpster fire of an explanation. It’s an insult to anyone with a functioning brain stem. You don’t see a 350% surge three months after a press release. That’s not how time works. This wasn’t a delayed reaction; it was a detonation. And the fuse wasn't lit by some brilliant Wall Street analyst. You can almost hear the frantic clicking of a thousand Robinhood apps, the glow of Discord channels lighting up basements across the country.

The Anatomy of a Ghost Rally

So, if it wasn't the "news," what was it? The answer is as simple as it is stupid: math and market mechanics. Xenetic has what’s called a "low float." With only about 1.3 million shares available for public trading, its a ghost town of a stock.

Think of it like this: a low-float stock is a tiny, empty dive bar. On a normal night, a few regulars shuffle in and out. But on October 8, someone blasted a signal to every trader in the digital city, and 30 million people tried to cram through the door. The bar itself didn't get bigger or better—it didn't suddenly get a Michelin star. But the sheer chaos of bodies flooding in and out created the illusion of the hottest party on the planet. The price didn't soar because Xenetic became more valuable; it soared because there was a manufactured stampede for a handful of tickets.

This is the game now. Algorithms and coordinated groups of retail traders scan for these exact setups: a low float, a semi-plausible "story" (cancer research is always a good one), and a stock price low enough to feel accessible. They pile in, the price goes parabolic, the financial media scrambles to find a "reason," and the original crew cashes out, leaving a trail of bagholders who bought in at the top, convinced they were investing in the next Genentech.

And where did this swarm come from? Just look at the day before. Another biotech, Galecto (GLTO), had its own absurd rally, spiking over 600% on… you guessed it, no news. The next day, it crashed. It doesn’t take a genius to connect the dots. The locusts were just moving to the next field. XBIO, along with a few other small pharma stocks like UPC and XTLB, was just the next name on the list.

But What About the Science?

Now, someone will inevitably pop up in the comments and say, "But Nate, their science is promising! They're using DNase enzymes to break down tumor shields! It could revolutionize CAR-T therapy!"

And you know what? Maybe it could. Xenetic's work on Neutrophil Extracellular Traps (NETs) is genuinely interesting. The idea of dissolving a tumor's defensive web so that treatments can get in is clever. They have preclinical data from Scripps that looks good in mice, and they’ve started a couple of tiny, exploratory Phase 1 trials in Israel for pancreatic cancer and lymphoma. That’s all true.

It’s also completely and utterly irrelevant to the 160% one-day stock spike.

This company had $4.8 million in cash as of June. Their quarterly net loss is around $700,000. They are, by their own admission, a development-stage company with a long, brutal, and expensive road ahead. The science is a high-risk, long-shot bet that might pay off in five to ten years, or it might—and statistically, probably will—amount to nothing. It is not, under any sane model of valuation, worth 350% more today than it was last Tuesday.

The science isn't the reason for the rally; it's the alibi. It's the thin veneer of legitimacy that lets people pretend they're not just gambling. It’s the brochure for the timeshare. The story sounds good enough to justify the trade, but nobody who's really driving this train cares if the pancreatic cancer trial succeeds. They'll be long gone before the first patient's data is even analyzed. Are we really supposed to believe that this sudden frenzy is a rational assessment of early-stage trial data announced months ago? Or is it more likely that the stock's technical setup was perfect for a squeeze?

And what is the company's role in all of this? Silence. They haven't said a word. Are they just sitting back, watching their market cap explode, secretly preparing to dump a boatload of new shares on these speculators before the music stops? That's what I'd be doing. It's probably the most responsible move for their long-term survival, even if it torches the very people who just pumped their stock into the stratosphere.

Just Another Casino Chip

Look, I'm not a financial advisor. This isn't advice. It's an observation about the theater of absurdity that our market has become. A company's stock price is no longer a reflection of its business fundamentals or future prospects. It's a meme, a hashtag, a digital token to be flung around for a quick profit. The story of Xenetic in October 2025 isn't about medicine; it's about momentum. It’s a textbook example of a market completely detached from reality, where the only thing that matters is getting out before everyone else does. Some people will make a fortune. Most will get burned. And the actual science? It will continue its slow, methodical grind in a lab somewhere, completely oblivious to the madness.

Tags: xbio stock

Bitcoin's Price Action: Separating the Volatility Signal from the Market Noise

Next PostVanda Pharma's NHL & Arena Deals: What the Numbers Say About Their New Strategy

Related Articles