It’s happening. As the fourth quarter of 2025 kicks off, we’re watching Bit...

2025-10-03 28 bitcoin price today

Bitcoin crested $124,000 this week, printing a new all-time high and pushing its market capitalization past the $2.4 trillion mark. The headlines wrote themselves, and for a few hours, the crypto evangelists were proven right once again. You could almost hear the champagne corks popping from midtown Manhattan to Silicon Valley.

But if you felt a moment of euphoria watching the numbers climb, it was likely short-lived. Because in a move that has become painfully predictable, the ascent was met with a swift and vicious sell-off. The price plunged below $122,000, as detailed in Coindesk's report, Bitcoin (BTC) Price News: Dips Below $122K as XRP, Solana, ADA Plunge 5%, wiping out three days of gains in a matter of hours and dragging the rest of the market down with it.

This violent oscillation isn't just noise; it's a signal. It reveals the fundamental conflict at the heart of Bitcoin today. There are two distinct narratives driving this asset, and they are currently at war with each other. One is a tidy, long-term institutional thesis. The other is a chaotic, short-term speculative reality. And right now, the speculators are still in control of the price action.

The story being sold in boardrooms is compelling. BlackRock, the world’s largest asset manager, has effectively given institutional money the green light, framing Bitcoin not as a simple risk-on or risk-off asset, but as a "unique diversifier." The argument is clean, logical, and perfectly suited for a PowerPoint presentation.

First, Bitcoin exhibits a relatively low correlation with traditional equities. It doesn't march to the beat of the same macro-economic drum—interest rates, employment figures, GDP—that dictates the movement of the S&P 500. Second, it’s positioned as an elegant hedge against global monetary instability. Because it isn't beholden to any single government or central bank, it offers an escape hatch from jurisdictional risk and currency debasement.

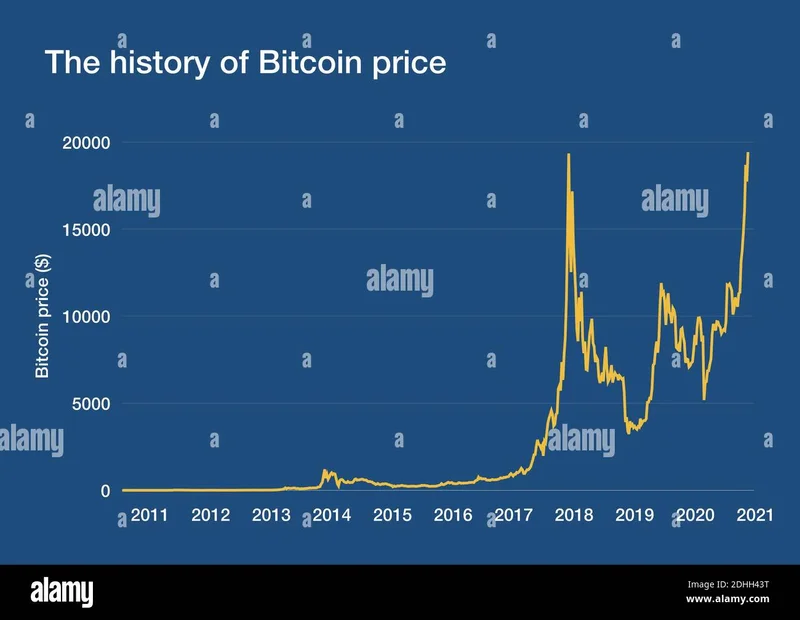

The data, on the surface, supports this. In the six major global crises since 2020, Bitcoin’s price has risen within 60 days of the event every single time. Its performance in these moments has often outpaced that of gold, the traditional safe-haven asset. It’s the digital gold thesis playing out in real-time. After all, gold’s value isn’t derived from its utility in jewelry or industry; that’s a sliver of its demand. Its $26 trillion valuation comes from its universal acceptance as a store of value—a financial insurance policy.

This is the narrative that fuels the ETF inflows. It’s a story of a maturing asset class finding its place in a diversified portfolio. But this polished prospectus tells you what Bitcoin could be. It doesn’t tell you what it is, day-to-day. What is driving the price to $124,688 and then immediately back down? Is it a sober re-evaluation of its role as a diversifier? Or is it something else entirely?

While the institutional story provides a solid foundation, the actual price action is built on a rickety superstructure of pure speculation. To understand the recent pullback, you have to look past the BlackRock reports and into the derivatives market. And this is the part of the data that I find genuinely concerning.

According to research from K33, the week leading up to the all-time high saw the strongest BTC accumulation of the year. A combined 63,083 BTC—worth roughly $7.7 billion, or to be more exact, $7.86 billion at the peak—was added across U.S. ETFs, CME futures, and perpetual swaps. Vetle Lunde, K33’s head of research, noted this surge was driven by widespread long positioning without a clear macro catalyst.

This is the market's equivalent of a poker player going all-in without even looking at their cards. It’s pure sentiment, fueled by leverage. This kind of explosive growth in open interest has historically preceded local tops. When everyone is on the same side of the boat, it doesn’t take much to tip it over. The market becomes a tinderbox, and the slightest bit of profit-taking can trigger a cascade of liquidations, flushing out the latecomers and over-leveraged traders. We saw it in January after the run to $109,000, in July at $123,000, and again in August at $120,000. Each peak was a mirage, disappearing as soon as traders tried to touch it.

This entire drama is playing out against a backdrop of significant macro uncertainty. Stephen Miran, a recent Trump appointee to the Federal Reserve, just stated his belief that the neutral interest rate should be 0.5% (a significant downward revision), citing tighter immigration and fiscal pressures. This suggests a complex economic path forward where the Fed has less room to maneuver than previously thought. Yet, the crypto derivatives market appears to be operating in a vacuum, completely detached from these fundamentals, driven instead by its own internal cycles of greed and fear.

The disconnect is staggering. There are essentially two different Bitcoin markets operating simultaneously. The first is the "prospectus market," a theoretical space where Bitcoin is a long-term, uncorrelated asset held by sober institutions as an inflation hedge. Its value is derived from sound economic principles and a belief in its future role in finance.

The second is the "casino market," the one that actually dictates the daily price. This market is a chaotic, 24/7 arena dominated by leveraged derivatives, algorithmic trading, and sentiment-driven momentum plays. Its movements are violent, its participants are fickle, and its primary function is to transfer wealth from impatient traders to patient ones.

The institutional story might be the correct one in the long run. But ignoring the reality of the casino is a fatal mistake for any investor. The real risk isn't that BlackRock's thesis is wrong; it's that individuals are buying into that thesis while unknowingly playing on a field governed by completely different rules. They are bringing a long-term investment strategy to a high-speed, high-leverage poker game. The price you see flashing on the screen isn't a reflection of the world's faith in decentralized finance; it's the volatile byproduct of these two markets colliding.

Tags: bitcoin price today

Related Articles

It’s happening. As the fourth quarter of 2025 kicks off, we’re watching Bit...

2025-10-03 28 bitcoin price today

It’s a strange feeling, isn’t it? To wake up and find the gears of governme...

2025-10-02 25 bitcoin price today