I remember the early days of the internet. That chaotic, dial-up-screeching...

2025-10-11 24 coinmarketcap

The crypto space is currently obsessed with architectural complexity. We’ve moved far beyond the simple elegance of a single-asset blockchain. Today’s projects arrive as intricate multi-chain ecosystems, complete with interlocking tokens, governance layers, and complex liquidity mechanisms. It’s a trend driven by a belief that more sophisticated engineering can solve the market’s inherent volatility and speculative chaos.

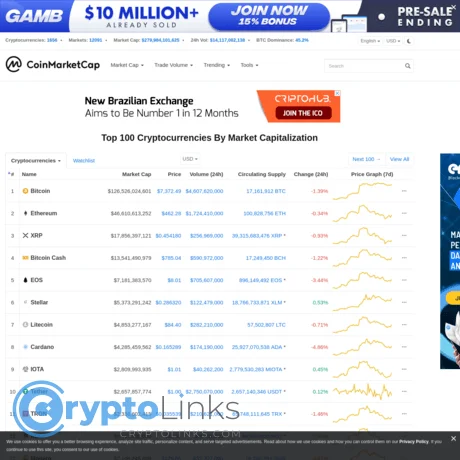

The latest and perhaps most ambitious entry in this category is XRP Tundra, a dual-chain protocol operating across Solana and the XRP Ledger. The project is generating significant search traffic on CoinMarketCap, which its proponents point to as evidence of organic interest. But as anyone who has spent time analyzing market data knows, search volume is a measure of attention, not a predictor of viability.

XRP Tundra’s model is built on a fundamental separation of powers. It issues two distinct tokens: TUNDRA-S on Solana for utility and TUNDRA-X on the XRP Ledger for governance and reserves. In theory, this isolates the network’s operational gas token from its long-term decision-making asset. The presale structure is also designed to project confidence, with defined launch valuations of $2.50 for TUNDRA-S and $1.25 for TUNDRA-X—a significant markup from the current presale price of about $0.09, or more precisely, $0.091 for the utility token.

This is a deliberate attempt to create a narrative of a clear, pre-defined path to value. But does bifurcating a project's soul across two different ledgers actually solve a problem, or does it just double the potential points of failure?

The core of XRP Tundra’s proposition isn’t its dual-token system; it’s the mechanism designed to protect it at launch. The project integrates Meteora’s Dynamic Automated Market Maker Version 2 (DAMM V2), a system that introduces adaptive fees to its liquidity pools. This is where the engineering becomes particularly aggressive. At launch, these fees are set to begin around 50% and then gradually decrease over time.

Let’s be clear about what this means. It’s a punitive tax on anyone who attempts to sell immediately after the token goes live. This mechanism is an overt, algorithmic defense against the pump-and-dump bots and presale flippers that plague nearly every new project launch. I've looked at hundreds of tokenomic models, and this particular feature stands out. It's less of a market mechanism and more of a financial decompression chamber. Presale buyers are brought into the ecosystem at a low pressure (the presale price), but they are prevented from exiting into the high-pressure environment of the open market without facing a severe penalty. The system forces them to acclimate as the fees slowly normalize.

This raises a critical question: what is the true purpose of such a defense? Is it a sophisticated tool to foster a stable, long-term holder base, or is it an admission that the project anticipates massive sell pressure at launch? A 50% fee is not a gentle nudge; it’s a capital barrier. It effectively locks up liquidity, creating an artificial price floor in the most critical early moments. While this might deter bots, it could also frustrate legitimate early investors and distort the natural process of price discovery. The real test isn’t what the price does when the fee is 50%, but what happens when it drops to 5%, and then to a standard 0.3%. Can an algorithm truly tame human market psychology, or does it just delay the inevitable reckoning?

The project’s spokesperson, Tim Fénix, claims the CoinMarketCap interest shows a clear distinction and that participants are seeking projects with "transparent mechanics and defined launch paths." This is a standard marketing narrative. The presence of smart-contract audits from firms like Cyberscope and Solidproof, along with a team KYC from Vital Block, certainly adds a layer of credibility. These are necessary checks for basic project hygiene, confirming the code does what it says it does and that the team is accountable (at least on paper).

But these are not indicators of market demand or product-market fit. They are simply the cost of entry in today's crypto environment. The real signal to watch is not presale search interest but post-launch behavior after the DAMM V2's protective fees have decayed. Will the project have cultivated a genuine community and use case by then, or will the delayed selling pressure simply be released all at once?

The broader market context is also telling. A press release, CoinMarketCap Trends Suggest XRP Tundra Presale Could Outpace Broader Bitcoin Market Gains, notes this interest is rising as Bitcoin consolidates. This correlation is often presented as investors seeking alpha in smaller projects when the market leader is stagnant. The alternative interpretation is that in a low-volatility environment, speculative capital simply flows to whatever new narrative is being marketed most effectively. The data on CoinMarketCap reflects curiosity, which is a far cry from conviction. We have no way of knowing how much of that search traffic converts into actual, long-term investment versus short-term speculative bets hoping to navigate the complex fee structure.

The entire framework is a fascinating experiment in financial engineering. It attempts to build a stable foundation by controlling the market’s most chaotic impulses through code. It’s a technocratic solution to a psychological problem. The structure is transparent, the audits are public, and the mechanics are clearly defined. Yet, the most important variable remains unknown: will anyone actually want to use the TUNDRA-S token for its intended utility once the speculative launch phase is over?

Ultimately, XRP Tundra presents a paradox. It has constructed one of the most elaborate, defensive launch mechanisms I’ve seen, designed to protect its token price from the very people who invested in it first. The dual-chain architecture and the DAMM V2 system are elegant pieces of engineering. But no amount of code can create genuine, sustainable demand. The project’s success will not be determined by its ability to penalize sellers in the first week, but by its ability to create compelling reasons for people to buy and hold for the next fifty-two. Right now, it's a beautifully designed ship built for a storm, but it's not clear what destination it's sailing toward.

Tags: coinmarketcap

Related Articles

I remember the early days of the internet. That chaotic, dial-up-screeching...

2025-10-11 24 coinmarketcap