The Next Great Stock Market Rally: Why This Week's Signals Point to a New Beginning

The glow of the stock ticker on a Friday afternoon used to be a signal to wind down. Now, it feels like a starting pistol. Seeing the Dow Jones Industrial Average—that old, stalwart measure of American industry—punch through 47,000 for the first time wasn't just another broken record. It felt different. It felt like the hum of a system hitting a new resonant frequency, a palpable energy coursing through the circuits of the global economy.

This week, that energy is set to arc and spark in a dozen different directions. The Federal Reserve will deliberate on the cost of money itself. Titans of our new digital age—Meta, Microsoft, Alphabet, Apple, and Amazon—will open their books and tell us how the future is selling. And across the Pacific, two presidents will sit down in a high-stakes negotiation that feels both critically important and strangely archaic, like two kings deciding the fate of a railroad that has already been bypassed by a starship.

It’s easy to get caught up in the daily horse race. Will Powell cut rates? What will Tim Cook say about iPhone demand? Can Trump and Xi find common ground? But I believe if you focus only on these questions, you’re missing the real story. You’re watching the waves, not the tide. And the tide that’s coming in is one of the most powerful technological and economic shifts in human history.

The Signal in the Noise

Let’s be clear: the market is not just "up." It is being fundamentally rewritten. When you see a statistic like the one from S&P Dow Jones Indices—that the "Magnificent Seven" tech stocks have accounted for roughly 41% of the S&P 500's entire gain this year—you have to pause. When I first saw that figure, I honestly just sat back in my chair, speechless. This isn't a broad, gentle lift. This is a radical re-centering of our entire economic universe around a handful of companies that are building the very infrastructure of tomorrow.

Think about it. We’re not talking about companies that make slightly better widgets. We’re talking about the architects of artificial intelligence, the masters of global logistics, the builders of the digital platforms where we live, work, and dream. The fact that 86% of S&P 500 companies are beating earnings expectations is fantastic, but the deeper truth is that many of them are doing so by leveraging the tools and platforms created by this dominant technological core.

This is the 21st-century equivalent of the rise of the railroad. In the 19th century, it didn't matter if you were a farmer, a steel mill owner, or a textile manufacturer; your success was suddenly and inextricably linked to the iron rails crisscrossing the country. Today, that iron rail is cloud computing, AI, and global digital marketplaces. The market isn't just rewarding profits; it’s placing a massive, collective bet on the source code of our future economy.

What, then, do we make of the anxieties? The warnings of a "high risk bull market" from sharp minds like Bob Doll, or the very real squeeze on household spending that Bob Elliott points to? These aren't contradictions; they are symptoms of the transition. They are the friction generated when an old world grinds against a new one.

Our Analog Brains in a Digital Storm

The truth is, we’ve built a rocket ship, but we're still trying to fly it with the intuition of a horseback rider. Our psychology, our emotions, and even our economic metrics are struggling to keep pace with the sheer velocity of this change.

This is where the "fear of missing out" that Sam Stovall mentions comes from. It’s not just greed. It’s a primal, human reaction to seeing a new world being built and desperately wanting to be a part of it. The market is "running on adrenaline" because the pace of innovation itself is an adrenaline rush—you have AI breakthroughs fueling productivity, biotech pushing the boundaries of life, and global networks connecting billions all at once and the market is trying to process this explosion of value while simultaneously worrying about a 25-basis-point rate cut. It’s a dizzying, beautiful, and yes, terrifying spectacle.

It also explains why our old maps seem so unreliable. Look at the brilliant point Charlie Bilello made, calling the official government inflation data for health insurance "absurd." The government uses a complex basket of goods to measure inflation—in simpler terms, it's an attempt to average out the cost of everything from milk to surgery—but when a foundational pillar of your life like healthcare costs feels like it's skyrocketing by 26%, an official statistic claiming it dropped feels like a gaslight. Our systems for measurement were designed for a slower, more linear, industrial economy. They are becoming profoundly misaligned with the realities of a digital, service-based world where value is created in ways we’re still learning to quantify.

This is the great challenge of our time. The very forces creating unprecedented wealth and capability are also generating turbulence and dislocation. The power concentrated in these few foundational tech companies carries with it an immense responsibility. We, as a society, have to consciously steer this incredible engine toward shared prosperity, not just shareholder value. The question isn't whether we can stop this change—we can't—but whether we have the wisdom to shape it.

This Isn't a Bubble; It's a Birth

Forget the day-to-day panic. Step back and look at the bigger picture. The debate is shifting, with some now arguing, Think the stock rally is over? It may just be beginning - CNN. The volatility, the arguments over inflation, the geopolitical posturing—they aren’t signs that the system is broken. They are the growing pains of a new one being born. What we're seeing in these record-breaking market numbers is not the irrational euphoria of a bubble, but the messy, chaotic, and profoundly hopeful process of the future being priced into the present. This is a long-term vote of confidence, however clumsy, in human ingenuity. And I believe it’s a bet we’re going to win.

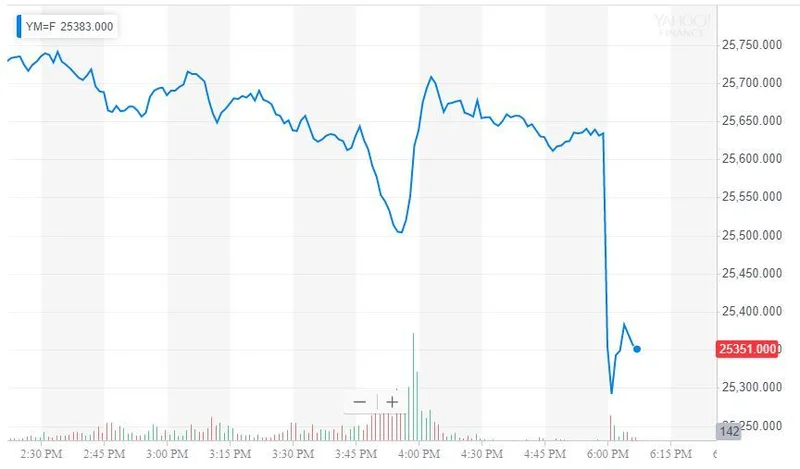

Tags: dow jones stock futures

The Coming Revolution in Podcasting: How AI is Creating a Personal Audio Revolution

Next PostWaste Management (WM) Stock Dips After Q3 Earnings Miss: Analyzing the Price Drop and Dividend Outlook

Related Articles