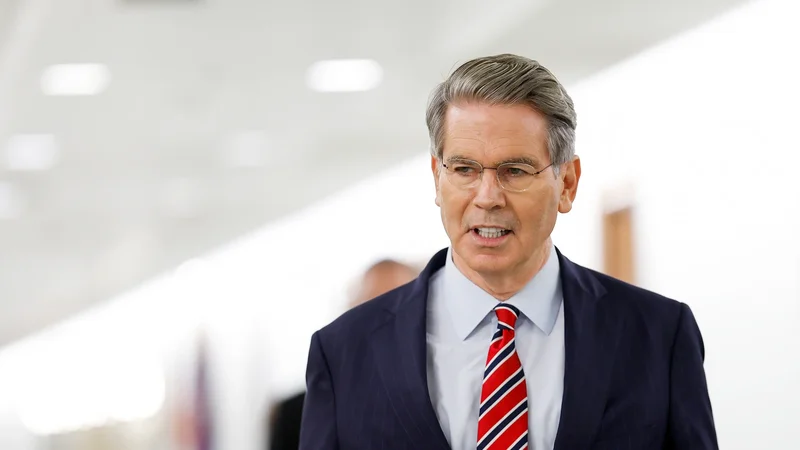

Scott Bessent's $20 Billion Argentina 'Rescue': What We Know and Why It's Already a Mess

Let me get this straight. While we’re busy arguing about whether we can afford to keep our own government running and the price of a carton of eggs is still a national conversation, the US Treasury decides now is the perfect time to play international hero and buy up a bunch of Argentine pesos?

You heard that right. Treasury Secretary Scott Bessent, a guy who made his bones betting against the British pound, just announced on social media—because that’s where we make monumental financial policy now, apparently—that the US is swooping in to save Argentina. We’ve "finalised terms" for a cool $20 billion financial rescue and, for good measure, started buying their currency directly, as Bessent says US purchased pesos and finalized framework for $20 billion lifeline for Argentina.

I had to read that twice. We are actively purchasing a currency that's in freefall to prop up the government of Javier Milei, Trump's "chainsaw-wielding" libertarian buddy. Bessent says the success of Argentina's "reform agenda" is of "systemic importance." Systemic importance to whom, exactly? Because from where I'm sitting, it looks a hell of a lot like a political favor wrapped in the language of economic stability.

The 'Not a Bailout' Bailout

Bessent went on Fox News to assure everyone that this isn't a bailout. Offcourse, it isn't. And I'm sure the $20 billion is just a friendly loan between pals, right? This is a "currency swap line," which is the kind of sterile, bureaucratic term you use when you don't want people to realize what's actually happening.

Let me translate. Giving Argentina a $20 billion currency swap is like giving a gambling addict a fresh line of credit at the casino. You're not fixing the underlying problem; you're just giving them more chips to play with, hoping they don't lose it all again. It allows Argentina to trade its rapidly devaluing pesos for stable US dollars, creating a temporary illusion of stability. But what happens when that line of credit runs out? Do we just cut them another check? Are American taxpayers now the unofficial patrons of the Argentine central bank?

The Treasury is being suspiciously quiet about the details. How many pesos did we buy? What are the exact terms of this $20 billion "lifeline"? They didn't respond to questions, which is exactly what you'd expect from an agency that knows its story is flimsy. Bessent claims the peso is "undervalued." That’s a hell of a gamble to take with our money, isn't it? He’s a trader by nature, and it sounds like he’s making a massive trade on behalf of 330 million Americans who didn't get a say in the matter.

It's all so maddeningly vague. I tried to do a foreign currency exchange for a trip last year and my bank treated me like I was trying to pull off a heist, hitting me with fees and terrible rates. But the government can just... buy a foreign currency on a whim? And for what, exactly? To prop up a guy who campaigns with a chainsaw and...

This isn't about sound economic policy. This is about appearances. It’s about making sure Trump’s ally doesn’t face-plant right before his midterm elections on October 26th. Milei’s party just took a beating in a provincial election, investors are dumping Argentine bonds like they’re radioactive, and the country is about to have billions in debt payments come due. This isn't a liquidity crisis; it's a confidence crisis. And you can't fix a lack of confidence with a cash infusion. You just postpone the inevitable collapse.

'America First,' Unless Your Friend Needs Cash

The absolute best part of this whole mess is the spectacular hypocrisy. This is the Trump administration we're talking about. The "America First" crowd. The people who, quite rightly sometimes, question why we're sending money all over the world when we have crumbling infrastructure and struggling families at home.

And yet, here we are, printing dollars to save a foreign economy. It’s a joke. Senator Elizabeth Warren—not my usual political ally, but a broken clock is right twice a day—nailed it when she said, "Instead of using our dollars to buy Argentine pesos, Donald Trump should help Americans afford health care." She's not wrong. The optics are just staggering.

This is a bad idea. No, 'bad' doesn't cover it—this is a five-alarm dumpster fire of political cronyism disguised as foreign policy. Bessent’s statement that "a strong, stable Argentina... is in the strategic interest of the United States" is pure, uncut PR fluff. What he means is that a Milei-led Argentina is in the political interest of the Trump administration. They want their guy to win. They want to be able to point to a free-market success story in South America, and they're willing to underwrite the project with our money to make it happen.

Bessent even had the gall to say this should be a "bipartisan priority." A bipartisan priority? Helping Americans is a partisan dogfight, but bailing out a foreign government should be a moment of national unity? Give me a break. Then again, maybe I'm the crazy one here. Maybe this is just how the world works, and I'm the only one left who thinks our own country should be our first priority. It just feels like we’re watching a magic trick where the magician keeps insisting there’s nothing up his sleeve while a giant pile of our money disappears into his hat.

So, Who's Footing the Bill?

At the end of the day, it's all just words. "Currency swap," "systemic importance," "strategic interest." It’s a word salad designed to obscure a simple truth: The administration is using taxpayer-backed funds to prop up a political ally whose radical economic experiment is on the verge of imploding. They're betting on a friend, and they're using our wallet to cover the wager. If it works, they'll declare victory. If it fails, well, it's just another rounding error in the federal budget, and you and I are left holding the bag. Again.

Tags: scott bessent

Aster's So-Called 'Integrity Crisis': What the Wash-Trading Allegations Really Mean

Next PostFintech Founder Ozan Özerk: Analyzing His Global Expansion and Core Fintech Thesis

Related Articles