The Future of Your Tax Return Is Here—And It’s Not What You Think

The Unseen Algorithm of Empathy: How Even the IRS is Learning to Be More Human

We tend to think of government agencies, especially the IRS, as monolithic structures. They’re like old mainframes running on ancient, unchangeable code—impersonal, rigid, and utterly indifferent to the messy reality of human lives. We input our numbers, the machine processes them, and it spits out a result. There’s no room for nuance, no allowance for catastrophe. It’s a system of rules, not a system of reason or compassion.

At least, that’s the story we tell ourselves. But as someone who has spent a lifetime studying complex systems, I’ve learned that even the most colossal structures can evolve. Sometimes, you just have to know where to look for the updates. And recently, I saw a patch get pushed to the system that honestly made me sit back in my chair, speechless. It came in the form of a press release about tax relief for Alaskans hit by the remnants of Typhoon Halong.

This wasn’t just a minor tweak. This was a fundamental, albeit temporary, rewrite of the core operating principle from “the rules are the rules” to “human beings are in crisis, and the rules must bend.” The IRS announced that individuals and businesses in several of Alaska’s hardest-hit regions now have until May 1 to file returns and make payments. Think about that. The system, that big, scary, unfeeling machine, paused its own relentless clock because a community was hurting. It’s a glimpse of something profound: a bureaucracy learning to show grace.

The User Interface for Compassion

So, how does a system designed for rigidity execute an act of flexibility? It’s one thing to announce relief, but it’s another to build the pathway for people to actually access it. This is where the abstract idea of “relief” meets the concrete reality of tax forms, and where most well-intentioned programs fall apart in a mess of complexity.

The mechanism here is surprisingly elegant, at least in principle. The IRS is allowing affected taxpayers to claim disaster-related casualty losses on either their 2025 return or, crucially, to amend their previous year’s return, 2024. This is a critical choice. Amending a prior year's return could trigger a much faster refund, getting cash into the hands of people who need it to rebuild right now, not a year from now. This is the kind of user-centric design you’d expect from a Silicon Valley startup, not a federal agency. It’s like discovering an old piece of software has a hidden feature that anticipates your most urgent need.

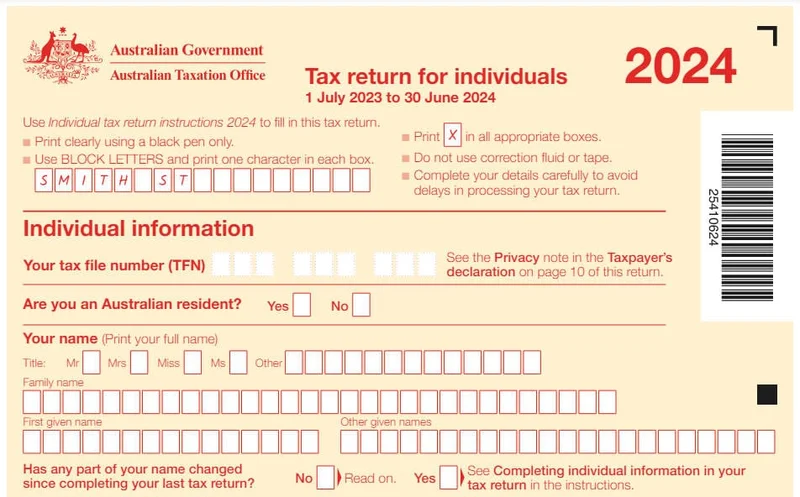

The tool for this is Form 1040-X, the Amended U.S. Individual Income Tax Return. Let’s be honest, the name alone sounds intimidating. But what is it, really? It’s essentially a tool for correcting the record. You use it to fix a filing status, claim a credit you missed, or, in this case, to tell the system about a catastrophic financial event that happened after you filed. For those who need to take this step, understanding How to File an Amended Tax Return with the IRS is the first practical hurdle. It uses a simple three-column logic: Column A is what you originally reported, Column C is the corrected amount, and Column B is the difference. It’s a mechanism for telling your financial story more accurately.

This isn’t just about filling out a form. It's about having an established, albeit clunky, protocol for dialogue with a system that usually only speaks in demands. The existence of an amendment process is, in itself, an admission that the initial record isn’t always the final word—that life is dynamic and the system must have a way to account for that. Is it perfect? Of course not. But is it a vital piece of code that allows for course correction? Absolutely.

A System That Anticipates, Not Just Reacts

This brings us to the bigger picture. The Halong relief effort is a powerful, human moment. But what if this wasn't an exception? What if it were the beginning of a new rule? Imagine a system that doesn't just react to disaster but begins to anticipate need. The IRS already automatically identifies taxpayers in a disaster area to apply relief—that’s a huge step. But we can go further.

The speed at which data flows today is just staggering—it means we can build systems that are not just responsive, but predictive and proactive in their compassion. We have weather models that can predict a storm’s path with incredible accuracy and economic models that can instantly assess the financial impact on a given zip code. Why can’t these systems talk to each other? Why can’t a FEMA declaration automatically trigger a provisional hold on IRS deadlines for everyone in the affected area, sending them a simple text message: “We know you’re going through something terrible. Don’t worry about us right now. We’ll be in touch when things are stable.”

This is the kind of breakthrough that reminds me why I got into this field in the first place. This isn't about building a "nanny state"; it's about building a "smart state." It's about using technology to remove bureaucratic friction during life’s most frictional moments. The shift from a paper-based, reactive system to a data-driven, proactive one is as significant as the leap from the abacus to the microchip.

Of course, this raises important questions. How do we build these systems without sacrificing privacy? How do we ensure the algorithms that determine need are fair and unbiased? These are not trivial challenges. The power to provide proactive help is also the power to surveil, and we must walk that line with incredible care and transparent design. But to shy away from the possibility because it's hard would be a failure of imagination. What could we achieve if we designed our civic systems with the same passion for user experience that we pour into our apps and gadgets?

We're Just Scratching the Surface

When you look at the IRS offering relief in Alaska, you can see it as a simple news story about a deadline extension. Or you can see it for what it truly is: a proof of concept. It’s evidence that we can, in fact, program our institutions to be more humane. We can embed empathy into the code of governance. The process is slow, and the interface is still clunky. But the update is being written, line by line, disaster by disaster. The future isn’t about tearing down old systems; it’s about rewriting them with a better, more compassionate logic. And we are just getting started.

Tags: tax return

Microsoft & OpenAI's New AGI Panel: What it Means for Their Roadmap and the Future of AI

Next PostCoinbase Stock: The stock price and its Bitcoin problem

Related Articles