Microsoft's $135B OpenAI Bet: What the Valuation Really Means for Investors

Microsoft's $135 Billion OpenAI Stake Is a Masterclass in Financial Engineering

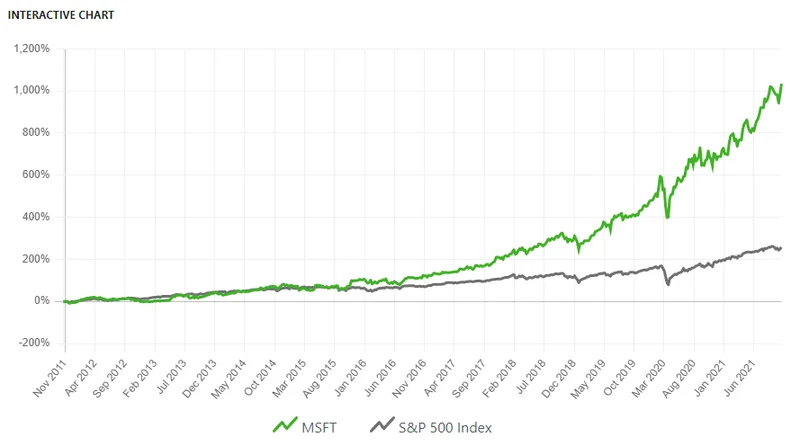

The digital tickers glowed an optimistic green in the pre-market hours Tuesday. Microsoft’s stock was climbing—about 4%, or 4.1% at the peak—and the proximate cause was a press release confirming a new definitive agreement with OpenAI. The headline number was staggering: Microsoft’s stake in the AI darling is now valued at approximately $135 billion.

Most of the commentary, such as reports that Microsoft stock rises after reaching deal with OpenAI with a $135B stake, focused on the strategic implications: extended IP rights, exclusive partnerships, and the race for Artificial General Intelligence (AGI). That’s the technology story, and it’s a compelling one. But it isn't the real story. The real story is a quiet, brilliant maneuver in corporate finance. What we just witnessed wasn't just a technology partnership being solidified; it was a masterclass in financial engineering, designed to turn a massive cost center into a monumental balance sheet asset.

While the rest of the market obsesses over a potential stock split and Azure growth rates, they’re missing the sleight of hand. The genius here is in the accounting.

From Drag to Propulsion

For years, Microsoft’s investment in OpenAI has been, from a purely accounting perspective, a drag on its earnings. The company poured billions into a partnership that required immense computational resources (read: Azure server time) and capital. Evercore ISI analyst Kirk Materne quantified this, estimating that OpenAI currently represents about a $0.60 per share drag on Microsoft’s EPS. That’s a significant, recurring cost to subsidize the future.

This new agreement flips the script entirely.

By restructuring the deal and clarifying its stake—now roughly 27% of OpenAI Group PBC—Microsoft is positioned to change its accounting method. It can move from the equity method, which reflects the ongoing losses and investments, to a fair value method. I've looked at hundreds of corporate filings, and this particular shift from equity to fair value accounting is where the real magic happens. It’s the kind of move that makes accountants, not just engineers, into heroes.

Under a fair value method, Microsoft would recognize a massive, one-time, unrealized gain from the OpenAI relationship. That $135 billion figure isn't just a vanity metric; it’s a number that will likely soon appear on Microsoft’s books, transforming the income statement. The $0.60 EPS drag doesn’t just disappear; it could be replaced by a significant paper gain. It’s the financial equivalent of turning lead into gold. What was once a costly R&D venture now becomes a gleaming asset that bolsters the company’s already colossal market cap.

This is the core of the engineering. Microsoft has effectively used its own capital and cloud infrastructure to incubate an entity, and is now on the verge of booking the appreciation as a financial gain. But how much of that $135 billion valuation is based on concrete, discounted future cash flows versus the market's insatiable, and perhaps irrational, appetite for anything labeled "AI"? And will regulators ever scrutinize a parent company essentially marking its own homework to create such a colossal paper gain?

The Stock Split Sideshow

Simultaneously, a different narrative has been consuming oxygen in the financial media: the prospect of a Microsoft stock split. The logic is sound, if a bit archaic. At over $500 per share, Microsoft is the third-priciest component of the Dow Jones Industrial Average, a price-weighted index where a high stock price gives a company disproportionate influence. A split would bring it more in line with its peers (like Apple and Goldman Sachs) and make whole shares more accessible to smaller retail investors.

The company hasn’t split its stock since 2003, a lifetime ago in the tech world. The debate, captured in questions like Will Microsoft Announce a Stock Split on Oct. 29?, is a perfect distraction.

It’s like watching a street magician. While you’re focused on the hand shuffling the cards, the other hand has already pocketed your watch. The stock split is the card shuffle. It’s a cosmetic change that has no fundamental impact on the company’s value. It simply divides the same pie into more slices. Yet, it captures the imagination because it’s simple to understand and often creates a short-term flurry of retail interest.

The real value creation, the structural change to Microsoft’s long-term financial profile, is happening within the dense legalese of the OpenAI agreement. While analysts debate the psychological impact of a 10-for-1 split, Microsoft’s finance department is preparing to potentially add over a hundred billion dollars in asset value to its balance sheet. This isn't just a minor detail; it’s a tectonic shift in how the company's value is presented to the world.

The fundamentals are, of course, still strong. The last quarterly report was solid, with revenue up 18% and Azure growth hitting an incredible 39%. But even that spectacular cloud growth is part of a known narrative. The market expects it. The OpenAI revaluation, however, is an anomaly—a step-change event that fundamentally alters the financial DNA of the company. Is the market truly pricing in this accounting alchemy, or is it still fixated on the more tangible, but arguably less impactful, drama of a potential stock split?

An Accountant's Victory

Ultimately, the story of Microsoft's renewed OpenAI deal isn't about AI supremacy, at least not yet. It’s about financial supremacy. This move ensures that for the foreseeable future, Microsoft’s earnings reports will be flattered by a financial maneuver executed today. They have successfully converted a massive operational expense into an even more massive financial asset. It's a clean, elegant, and brutally effective piece of corporate strategy that demonstrates the true power in Redmond resides not just with the coders, but with the accountants. The technology is the product, but the financial engineering is the masterpiece.

Tags: msft stock

PayPal's Stock: Another Day, Another Baffling Price Swing

Next PostNASA's 'Quiet' X-59 Jet Finally Flies: The First Flight and the Big 'So What?'

Related Articles