Generated Title: Rooftop Solar Isn't Dead, It's Just Getting a Second Wind:...

2025-11-07 11 solar incentives

A predictable deadline is a curious thing in markets and politics. Everyone can see it coming, yet the frantic activity is always reserved for the final moments. We’re witnessing a textbook case of this phenomenon right now in the U.S. renewable energy sector, as a federally mandated policy cliff approaches. The 30% Federal Investment Tax Credit (ITC) for residential solar, a cornerstone of the industry’s growth, is set to expire at the end of 2025. For larger commercial projects, the deadlines are even more pressing.

The catalyst is a piece of legislation signed by President Trump, dubbed the "One Big Beautiful Bill Act," which schedules the phase-out of incentives previously extended under the Biden administration's Inflation Reduction Act. The new rules are stark: to qualify for the full credits, major wind and solar projects must break ground by July 4, 2026. Miss that date, and the project must be fully operational by December 31, 2027—a timeline widely considered unworkable for complex energy infrastructure.

This isn't a surprise. It’s a date circled on calendars in statehouses and corporate boardrooms for months. Yet the reaction has the distinct feel of a last-minute scramble, exposing the fragile, subsidy-dependent architecture of the green energy transition. We’re seeing a flurry of state-level executive orders, corporate marketing blitzes, and contentious legislative debates, all revolving around a single question: what happens when the federal safety net is pulled away?

To understand the on-the-ground impact, look no further than Oregon. Governor Tina Kotek recently issued an executive order compelling state agencies to “take any and all steps necessary” to fast-track permits for renewable projects. The objective is clear: push as many "shovel-ready" projects over the July 2026 finish line as possible. The stakes are quantifiable. One analysis suggests Oregon stands to lose about 4 gigawatts of planned wind and solar energy—enough to power roughly 1 million homes—if these projects miss the deadline. Nine specific projects are already flagged as being at risk. Oregon Fast-Tracks Renewable Energy Projects as Trump Bill Ends Tax Incentives

On its face, the governor’s order seems like a decisive, logical response. But this is where my analysis hits a snag. The state’s own sluggish permitting process is only one of two major hurdles. The other, and arguably the more significant, is the massive backlog in the federal transmission queue. Most of the grid in the Northwest (around 75%) is owned by the Bonneville Power Administration, and its lines are functionally full. Getting approval to connect a new project can take years. So, does fast-tracking a state permit solve the fundamental bottleneck of an overloaded grid? Is this executive order a meaningful solution, or is it primarily political signaling against an immovable object? The data suggests the latter may be closer to the truth.

And this is the part of the analysis that I find genuinely puzzling. While Oregon is pushing the accelerator to the floor to meet a federal deadline, California is actively debating pumping the brakes on its own long-standing incentives. Assemblymember Lisa Calderon has introduced legislation that would slash the benefits for nearly 2 million legacy solar customers—those who installed panels before April 2023. The rationale is purely economic. Proponents argue that the old subsidy model overcompensates solar owners and shifts the cost of grid maintenance onto non-solar customers, amounting to a cost shift of about $8.5 billion last year alone. To be more exact, they claim the average non-solar ratepayer in Calderon's district is paying an extra $230 a year. Solar incentives targeted

Here we have two neighboring states, both leaders in renewable energy, taking diametrically opposed actions in response to subsidy economics. Oregon is desperately trying to maximize expiring federal funds, while California is trying to claw back what it now deems overly generous state funds. This isn't a coherent, nationwide energy strategy. It's a chaotic, state-by-state reaction to the whiplash of federal policy.

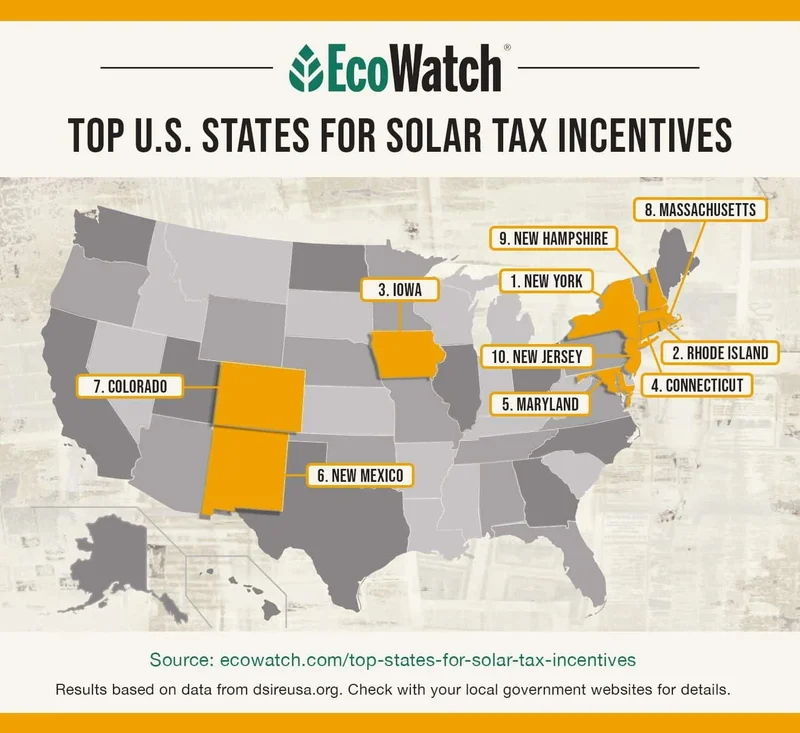

Into this chaos steps the private sector. Companies like Saxon Capital Group are, quite rationally, capitalizing on the confusion. They’ve launched a comprehensive "state-by-state solar incentive guide," positioning it as a tool to help homeowners navigate the post-ITC landscape. The marketing pitch is slick: the 30% federal credit may be disappearing, but a patchwork of state, municipal, and utility-level rebates still exists! It’s a message of reassurance, timed perfectly to capture the attention of consumers worried they’re about to miss out.

I've looked at hundreds of these corporate press releases, and the timing here is, shall we say, impeccable. Saxon is also heavily promoting its proprietary "Energy Glass," a transparent solar-collecting window technology. By bundling a resource guide with a product pitch, they’ve created a sophisticated marketing funnel designed to capture customers in a state of government-induced panic.

But let's apply some basic financial scrutiny. Can a collection of smaller, localized incentives truly replace the impact of a blanket 30% federal tax credit? It seems highly improbable. The federal ITC was a powerful, simple, and universal driver of adoption. Relying on state-level programs to fill that void is like trying to patch a hole in a battleship's hull with duct tape. It might slow the leak, but it doesn't fix the fundamental structural damage. The unspoken truth is that, for many potential customers, the math on solar is about to get significantly worse.

The entire situation reveals the core vulnerability of an industry built on a foundation of shifting political sands. Instead of fostering a market that can stand on its own through technological and economic efficiency, decades of stop-and-go subsidies have created a system perpetually dependent on the next legislative handout. The current scramble isn't a sign of a healthy, maturing industry. It's the entirely predictable outcome of a market conditioned to chase subsidies rather than sustainable, unsubsidized profitability.

What we're observing isn't a transition; it's a lurch. The abrupt termination of federal incentives doesn't create a smooth runway for innovation or cost reduction. It creates a cliff, prompting a panicked, inefficient rush to spend capital before the deadline. Resources are misallocated, projects are hastily planned, and the entire ecosystem is subjected to a boom-and-bust cycle dictated not by consumer demand or technological breakthroughs, but by the arbitrary dates in a congressional bill. This is not the hallmark of a stable, long-term energy strategy. It is the signature of a system designed for perpetual inefficiency.

Tags: solar incentives

Related Articles

Generated Title: Rooftop Solar Isn't Dead, It's Just Getting a Second Wind:...

2025-11-07 11 solar incentives