It’s rare to see a price chart that looks less like a market asset and more...

2025-10-16 22 ChainOpera AI

Alright, let's cut the crap. You see a headline like The Secret Behind ChainOpera AI’s Explosive Success: Strategic Cycle Timing and a Fully Diluted Valuation Beyond $4 Billion and you’re supposed to be impressed. You’re supposed to see the future of finance, the dawn of a new technological era.

I see a new paint job on a slot machine.

The project is ChainOpera AI ($COAI), and on September 25th, it exploded onto the scene with all the subtlety of a firework in a library. It landed on Binance, Bybit, and a handful of other exchanges, and within what felt like minutes, the numbers started getting stupid. A $4 billion Fully Diluted Valuation. Over $6 billion in perpetuals trading volume on a single day, a figure that put it in the same league as Bitcoin and Ethereum for a hot second.

Three million "AI users." 300,000 of them using BNB to access its services.

Everyone seems to be cheering. The crypto influencers are tweeting fire emojis. The project’s Telegram is probably a mess of rocket ships and “WEN LAMBO” GIFs. But I have to ask the question nobody else seems to be asking: are we celebrating a genuine breakthrough, or are we just celebrating the market’s bottomless appetite for a good story?

Let’s be real. ChainOpera AI didn’t launch in a vacuum. It launched into the warm, welcoming updraft of a crypto bull market gone wild. This is like launching a new brand of surfboard during a tsunami; you’re going to get a hell of a ride whether your board is made of carbon fiber or cardboard.

The timing was impeccable. This is a brilliant marketing play. No, 'brilliant' isn't right—it's a perfectly cynical marketing play. The BNB ecosystem was on an absolute tear, with the price of BNB itself rocketing from $500 to $1,300. According to Cointelegraph, the BNB Chain was raking in more on-chain fees than anyone else. And perpetual futures, the high-leverage gambling instrument of choice for the modern degen, were seeing daily volumes north of $100 billion on the chain.

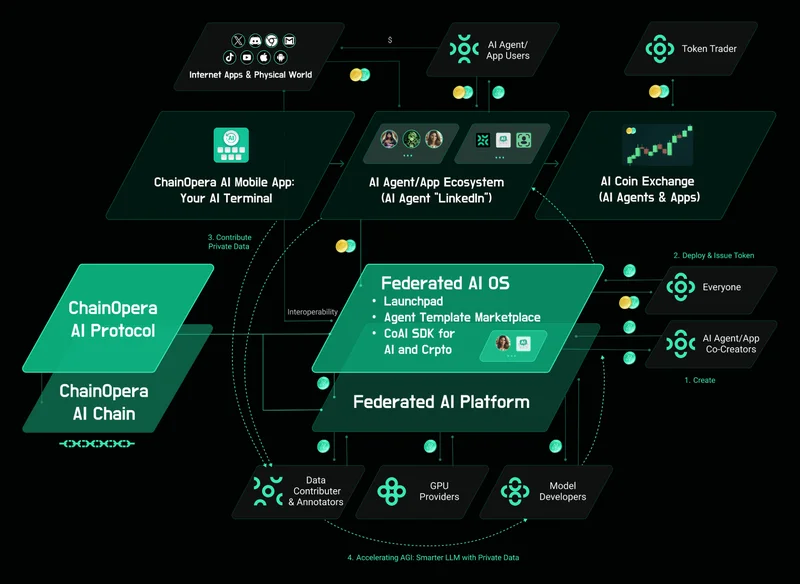

So, ChainOpera AI, a "full-stack AI infrastructure and Agent network system" built on BSC, shows up right then? It’s not a coincidence. It’s a strategy. They saw a casino where every table was packed and simply opened a new one with a flashing “AI” sign above it. Offcourse people flocked to it. When the entire market is a party, nobody wants to be the guy standing in the corner asking what’s in the punch.

And what about those 3 million "users"? What does that even mean? Is a "user" someone who connected their wallet once out of curiosity? Is it someone who ran a single free query? How many are real, engaged people, and how many are bots designed to plump up the numbers for a press release? We don't have those details, and I suspect that's by design.

The project bills itself as the top dog in the "AI Agent track." It’s a fantastic piece of jargon. It sounds sophisticated and futuristic. But what is an "AI Agent" in this context? Is it a truly autonomous piece of software making intelligent decisions on the blockchain, or is it a set of pre-programmed scripts that execute trades? Because one of those is revolutionary, and the other is just a fancy calculator with a token attached.

They say 40,000 of their product users converted into $COAI token holders after the launch. This is presented as a sign of a strong, loyal community. I see it differently. I see 40,000 people who were already in the ecosystem getting an early chance to buy into the hype. Are they believers in the long-term vision of decentralized AI, or are they just flipping a hot new token in a bull market? Given the $6 billion in perps volume, I’m leaning toward the latter.

This whole thing feels less like a tech company and more like a financial product wrapped in a tech company’s skin. The collaboration with ASTER to drive DEX perpetuals trading synergy says it all. The primary goal seems to be generating trading volume, not building a foundational AI network. The project is positioned as the top-valued project, and its a clever way to frame it because valuation in crypto is just a collective hallucination based on supply, demand, and memes.

Then again, maybe I'm the crazy one here. Maybe I’m just an old man yelling at a digital cloud. Perhaps this really is the future, and the line between a financial instrument and a technological revolution has simply blurred into non-existence. Maybe the valuation is completely justified, and the trading volume is a sign of genuine utility, and I’m just too jaded to see it. But I doubt it.

Look, I’m not saying ChainOpera AI is a scam. I’m just saying it’s the perfect product for this exact moment in time. It’s a flawless synthesis of the two most powerful, least understood buzzwords in our culture: AI and Crypto. They bolted them together, launched it into a market frothing with speculative cash, and—shocker—it was a massive success. The tech itself feels almost incidental. The "why" behind its $4 billion valuation has nothing to do with its code and everything to do with its timing. We're not investing in a vision; we're betting on a narrative. And right now, that's the only game in town.

Tags: ChainOpera AI

Related Articles

It’s rare to see a price chart that looks less like a market asset and more...

2025-10-16 22 ChainOpera AI

When I first saw the charts for ChainOpera AI (COAI , I honestly just leane...

2025-10-13 20 ChainOpera AI