So the press release, ICE Announces Strategic Investment in Polymarket, lan...

2025-10-08 22 polymarket

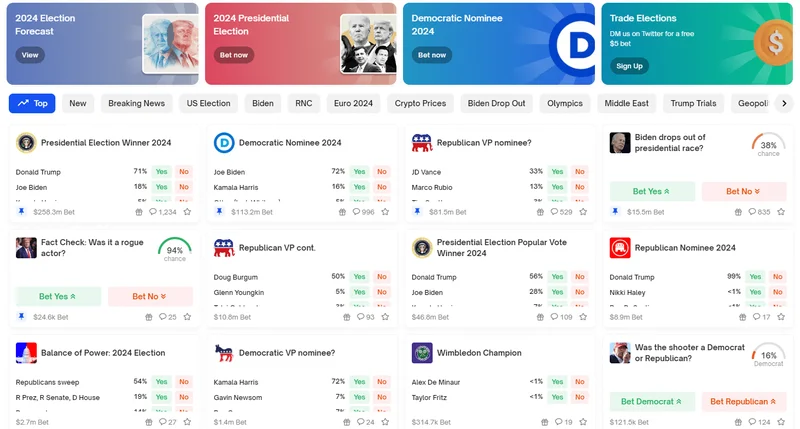

Okay, so Polymarket's monthly volume supposedly hit $3.02 billion in October, right? And they're patting themselves on the back for 38,270 new markets and almost half a million active traders. Give me a break. We're supposed to be impressed? Let's be real, people.

It's like they forgot they got slapped with a $1.4 million fine by the CFTC back in 2022 and had to slink out of the U.S. Now, suddenly, the CFTC's "softened its stance," and they think they can just waltz back in with a native POLY token and an airdrop to lure in the degens? Please.

This whole "airdrop" craze is what's really driving this, isn't it? Nick Ruck from LVRG Research says sentiment's shifted; people are chasing platform tokens instead of, you know, actually using the platform for anything meaningful. Smart money, I guess. Or maybe it's just more gambling, only this time the house gets a bigger cut.

And let’s not forget Kalshi. They’re casually raking in $4.4 billion in monthly volume – dwarfing Polymarket. And some VCs are throwing around valuations of up to $12 billion? What are they smoking? Seriously, are we just throwing money at anything with the word "prediction" attached to it? I mean, what happens when these "predictions" are wrong? Oh right, nobody cares, it's just "liquidity providing" and "arbitrage." Whatever. According to Polymarket activity rebounds to new highs while Kalshi dominates in volume - theblock.co, Kalshi is dominating the prediction market in terms of volume.

Honestly, I'm sick of these crypto platforms acting like they're doing us all a favor. They’re not. They're just trying to get rich off our FOMO.

Ruck also mentions "decentralized access and function as event-driven options trading." Translation: unregulated gambling for crypto bros. It's all smoke and mirrors. They claim to be giving power to the people, but it’s just a new way to fleece them.

I can’t help but wonder, is this really progress? Are we actually learning anything from these platforms, or are we just getting better at predicting which meme coin will pump next? And what about the average joe who gets sucked into this vortex of speculation? Are they really equipped to navigate this mess, or are they just going to end up holding the bag when the music stops?

I'm not saying prediction markets are inherently evil, offcourse. But this whole situation reeks of hype and short-term gains.

This ain't some triumphant return; it's a desperate grab for attention in a market saturated with scams and empty promises. Polymarket's counting on our collective amnesia and the allure of free money. Don't fall for it.

Tags: polymarket

Related Articles

So the press release, ICE Announces Strategic Investment in Polymarket, lan...

2025-10-08 22 polymarket