It’s difficult to ignore a number like $181,000. When an institution like C...

2025-10-05 17 ethereum price

It’s easy to get lost in the noise. Every day, a new headline screams a dizzying price target. Citi says the bitcoin price could hit $181,000. Another analyst on X warns of a bearish divergence. The ethereum price today is up, it’s down, it’s sideways. The charts flicker with greens and reds, a frantic digital heartbeat that mesmerizes and terrifies in equal measure. We track the BTC price like it's the only signal that matters.

But I'm going to tell you something that might sound strange, coming from a guy who loves data: I think we’re staring at the wrong screen.

The daily price action is a weather report in the middle of a tectonic shift. It’s fascinating, sure, but it’s not the real story. The real story—the one that will define the next decade—is happening quietly, in corporate boardrooms and on balance sheets, far from the roar of the trading floor. While we’re all obsessing over the charts, the world’s smartest companies are not just buying crypto; they’re rebuilding their financial foundations on top of it.

Let’s talk about something called a Digital Asset Treasury, or DAT. It sounds technical, but the concept is revolutionary. This isn't about a company buying a little Bitcoin as an inflation hedge, the way they might buy the gold price. This is something else entirely. They're creating what are called Digital Asset Treasuries, or DATs—in simpler terms, they're not just buying crypto as a speculative bet like you or I might, they're fundamentally integrating these digital assets into their core financial strategy.

It's the 21st-century equivalent of a company in 1998 deciding it needed a website. At first, it was a novelty. Then, it became an indispensable part of doing business. We are at that exact inflection point right now.

And the numbers are staggering. Forget the retail hype around Dogecoin or XRP. Look at a company like BitMine Immersion Technologies (BMNR). They now hold over 2.6 million ETH, worth north of $11 billion. Or SharpLink Gaming, with nearly 840,000 ETH. When I first saw the scale of BitMine's Ethereum holdings, I honestly had to double-check the numbers. We're talking about a multi-billion dollar bet on a network's utility. This is the kind of data that makes me realize the institutional shift is happening faster than any of us thought.

This isn't speculation. This is infrastructure. These companies aren't just betting on the price of ethereum to go up. They are leveraging the Ethereum network for its utility—for tokenization, for decentralized applications, for a future where assets are fluid, programmable, and global. So, while some analysts are trimming their year-end bitcoin price USD targets because of a stronger dollar, these companies are looking at a much, much bigger picture. What does it tell us when the people building the future are quietly stockpiling the bedrock of that future?

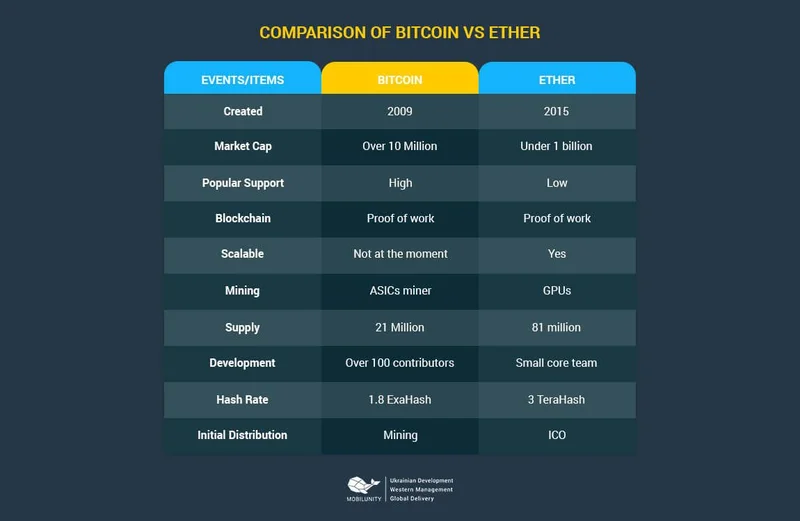

This is where the story pivots from Bitcoin to Ethereum, and it’s a crucial distinction. Bitcoin is brilliant. It’s digital gold, a pristine store of value in a world of monetary chaos. Citi is right to be positive on it capturing the lion's share of new capital flows—a sentiment reflected in headlines like Bitcoin, ethereum get bullish 12-month price targets from Citi. But Ethereum is something else. It's digital oil. It's the fuel for a new kind of economy.

The surge in corporate interest in Ethereum isn't random. It’s being driven by the explosion in tokenization and the need for robust platforms to handle things like stablecoins. This isn't just about finance, it's about tokenizing everything from real estate to art to intellectual property, creating liquid, global markets for assets that were previously stuck in dusty filing cabinets—the speed and scale of this transformation is something we're only just beginning to grasp.

Look at the on-chain data. The amount of ETH held on exchanges has fallen to a multi-year low of 16.1 million. This is the opposite of speculative froth. When reserves on exchanges are high, it means people are ready to sell at a moment's notice. When they’re this low, it means coins are being moved into cold storage or into decentralized finance protocols for the long haul. It's a powerful vote of confidence in the network's future. It's accumulation on a historic scale.

Of course, with this incredible power comes profound responsibility. As we build this new financial world, we have to ensure it’s more transparent, equitable, and accessible than the one it’s replacing. The code we write today will become the laws of tomorrow. That’s a heavy thought, but an inspiring one. We’re not just building apps; we’re architecting trust. What kind of world do we want to build with these powerful new tools?

So yes, keep an eye on the charts for Solana, Cardano, and the rest. The short-term price action is exciting. But don’t mistake the waves for the tide. The tide—the deep, powerful, inexorable current—is the institutional adoption of this technology as a foundational layer of the new economy. It's happening now, and it's the most bullish signal of all.

Forget the daily drama. The real signal isn't the price; it's the purpose. We are witnessing the slow, deliberate, and irreversible integration of decentralized technology into the core of our economic world. Companies aren't just speculating anymore; they're building. This isn't a bubble. It's a beginning.

Tags: ethereum price

Related Articles

It’s difficult to ignore a number like $181,000. When an institution like C...

2025-10-05 17 ethereum price